This past week was not a good one for cryptocurrencies. They surged into 2018 on the back of a phenomenal rise in valuations and unprecedented media attention.

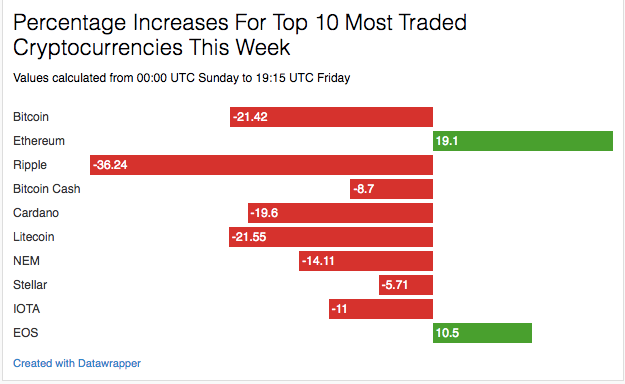

But the second week of 2018 brought a reality check. In a sea of red among the top 10 most- traded cryptocurrencies, ethereum was the only exception. Valuations for the overall market dropped to $698.1 billion from $828.5 billion.

News from Asia dominated price movements for bitcoin and other cryptocurrencies.

Here is a brief recap of major news stories that affected digital currency prices this week.

South Korea Considers Reining In 'Kimchi Premium'

South Korea came out charging against cryptocurrency trading midway through the week, with its Justice Minister stating that the government was considering a “ban” on cryptocurrency trading. Cryptocurrency markets reacted strongly and shed more than $100 billion of their total valuation in response to the news. (See also: Bitcoin Price Crashes On Fear Of South Korea Cryptocurrency Ban.)

The next day, however, brought about a change in stance. The Chairman of the Financial Services Commission (FSC), Choi Jong-ku, allayed fears and stated that his agency was still considering the extent of regulation. Members are divided over the extent of regulation because it could also potentially stifle fintech innovation. The South Korean won is the third-most traded fiat currency in crypto markets.

Investors in the country often pay a “kimchi premium" to trade in coins. (See also: Why Is South Korean Bitcoin Price $1,000 Over Global Prices.) Bithumb, the country’s largest exchange, accounts for over 37% of trading volume in Ripple’s XRP, which has surged since the New Year.

Increased regulation might not be such a bad thing for cryptocurrencies in South Korea, since it would bring order and more investors to a chaotic market. (See also: Is Coinbase Responsible For Ripple's Slide?)

China Cracks Down Bitcoin Miners

The other big news story this week was also from Asia. The Chinese government has asked local authorities to begin preparing for an “orderly exit” for bitcoin miners. The authorities plan to use an assortment of policy measures, from laws curtailing use of electricity to implementing land regulations, to drive them out of the country.

China became a popular destination for miners because it offered friendly government policies and cheap electricity. Those conditions can be replicated at other places, and several countries have already staked a claim for a slice of the market. Ordinarily, such a development would have had a detrimental effect on bitcoin prices. But China has not set a deadline for its goal. What’s more, high prices for bitcoin will ensure that bitcoin miners always make tidy profits. (See also: High Bitcoin Prices Boost Profits For Miners.)

How Should We Value Cryptocurrencies?

As of this writing, 42 cryptocurrencies have valuations upwards of $1 billion. This, despite the fact that they are yet to have a proven use case or application as an asset. Traders are mostly clutching at passing fancies, such as media mentions or social media presence, to explain their traction. But past experience has disproved their theories.

“If you are actually going to invest in the currency use case from a prevalent global phenomenon where everyone will use them, then the properties of those (crypto) currencies are terrible to have,” says Jake Brukhman, founder of CoinFund, a Brooklyn-based blockchain technology advisory and investment firm. According to Brukhman, forward-looking sentiments about decentralized networks are reflected in pricing for cryptocurrencies.

Warren Buffett, who is bearish on cryptocurrencies, chimed in again with his take this week, saying they will have “a bad ending.” In response, NYU’s "dean of valuation" Aswath Damodaran said that some cryptocurrencies will succeed while others will not. So it was foolish to put them all together in a big bucket. “Every single asset is being priced right now, it's not being valued,” he said.

Part of the problem is that it is still early days in the cryptocurrency Wild West. Territories and markets are still being staked out by players. Certain big players, such as bitcoin and ethereum, have emerged with distinct use cases. But the field is still wide open. (See also: How To Find Your Next Cryptocurrency Investment.)

Investing in cryptocurrencies and other Initial Coin Offerings ("ICOs") is highly risky and speculative, and this article is not a recommendation by Investopedia or the writer to invest in cryptocurrencies or other ICOs. Since each individual's situation is unique, a qualified professional should always be consulted before making any financial decisions. Investopedia makes no representations or warranties as to the accuracy or timeliness of the information contained herein. As of the date this article was written, the author owns small amounts of bitcoin. It is unclear whether he owns other bitcoin forks.

Read Again Broooh https://www.investopedia.com/news/bitcoin-price-weekly-recap-kimchi-premiums-chinas-bitcoin-miners-and-valuing-cryptocurrencies/Bagikan Berita Ini

0 Response to "Crypto This Week: Kimchi Premiums, China's Bitcoin Miners, Valuation Dips"

Post a Comment