A good rule of thumb in investing is to diversify. So instead of buying one cryptocurrency, why not buy four at once?

Look no further than the Coinbase Index, announced this week. Available initially to US accredited investors, the index will charge a 2 per cent management fee for investing in four out of five of the largest cryptocurrencies, weighted by market capitalisation.

Here's how the index would look:

As the FT's Chloe Cornish has pointed out, Coinbase are not the first to launch a crypto index. However the group is purportedly one of the largest crypto-exchanges, with funding from celebrity VCs such as Andreessen Horowitz and a revenue run-rate of $1bn, so maybe this one could attract significant (real) money.

A few things immediately jump out from the methodology paper, however.

In an equity index fund, say everyone's favourite the S&P 500, a company issuing new shares as part of a capital raise will often see their share price, and thus their market-cap and weighting in the index, decline.

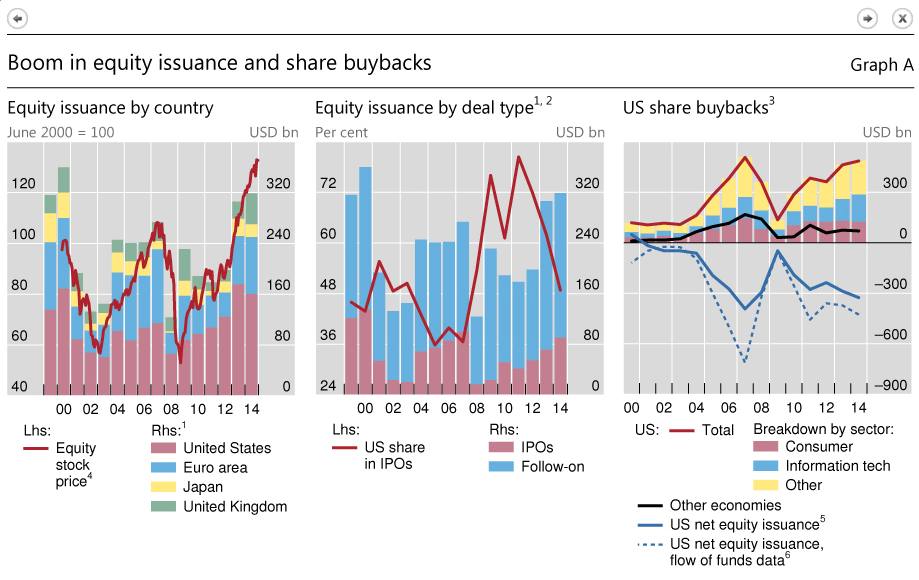

Not that much equity gets issued, overall - a Bank of International Settlements study from 2015 suggests the long term trend has been towards net-negative equity issuance in the US over the past two decades (see the chart on the right, open in a new tab to embiggen):

In comparison the four cryptocurrencies which make up the initial Coinbase Index are, by the very nature of the mining mechanism, continuously generating new tokens. From the methodology paper:

2.9 The supply of most digital assets increases on an ongoing basis, as defined by each asset’s blockchain protocol. These supply increases are usually referred to as block rewards or miner rewards — new units of the asset that are programmatically issued as a reward to network validators. These increases in supply have the potential to increase the market capitalization of the asset. CBI recognizes the effect of these increases by using the most recent supply figure for each asset in calculating the index level.

Whilst three of the coins, bar Ethereum, have dates where they will reach a fixed level of supply (for instance Bitcoin in 2140) the rate of issuance between the currencies varies significantly. So far, supply has had zero correlation to price (it is hard, after all, to dilute an asset without fundamentals).

Therefore it seems set up for Ethereum, all things remaining equal, to eventually become the largest constituent in the index. Albeit over a very long time horizon.

Coinbase have addressed this issue by proposing a separate fixed supply fund. Re-balanced annually, the weighting of the four constituent assets are adjusted relative to change in total supply across the index over the year.

Then there is liquidity.

The reason an institutional investor may want to pay 2 per cent annual management fees to own four cryptocurrencies is liquidity. It is notoriously difficult to convert cryptocurrencies into hard fiat quickly without materially affecting the market. For instance, last December Coinbase temporarily crashed as terrified hodlers scrambled to exit their long positions.

The liquidity issue partly derives from the indeterminate nature of the size of the free-float of each crypto-asset and the unequal distribution of hodlers, party from transaction volume constraints, and partly from an estimated 30 per cent of private keys in Bitcoin being lost.

Coinbase tacitly acknowledge this:

2.10 CBI (note: Coinbase Index) does not make any adjustment for units of an asset that have been lost or sent to provably unspendable addresses, or use a free float adjustment . Unlike traditional assets, for digital assets it is difficult to objectively determine the number of units actually available for purchase by investors, because there is no record of identity of the owners or holders of each asset. Therefore, it is difficult to determine whether or not any particular unit of an asset is held ready for trading on the market. For example, the private keys corresponding to the public address of those units could be lost or destroyed, meaning that these units are not available for trading. Therefore CBI reflects total current supply, without adjustment.

To translate: “If a big sell order comes in and we need to liquidate fast it could be problematic”.

Coinbase have come up with a solution to this liquidity issue and have gated redemptions from the fund to quarterly intervals with a 30 day notice. However, will an institutional investor be willing to pay a premium for restricted access to their capital?

A thought: if an investor requested their funds the week after the quarterly redemption, say 6th January when Bitcoin traded at around $17,000, would she receive the full value of her Bitcoin constituent on April1st, seeing as it is down 40 percent since? There is dangerous potential for asset-liability mismatches (which could work either way) and the answer to this issue is not made clear in the methodology document.

Fees of 2 percent have historically been associated with some level active management but the Coinbase Index comprises four relatively purchasable assets. Given the issues around liquidity and technology, perhaps Coinbase believe these fees represent some form of an expertise premium? It also could also be argued that investors won't mind 2 per cent management fees for exposure to tokens which can quintuple, or more.

Coinbase are following this line, product lead Reuben Bramanthan told the FT:

Asset management for cryptocurrency has a unique set of challenges compared to traditional assets, including secure custody and liquidity. We don't think it's accurate to compare fees for cryptocurrency asset management with fees for traditional asset management at this stage. As the technology and asset class mature over time, managing cryptocurrency will become easier and fees will likely change to reflect this. This is similar to the way that retail stock brokerage fees have come down over time, largely due to efficiency improvements created by better technology.

Amid heightened regulatory concerns around cryptocurrencies, including the Security and Exchange Commission's decision to bar cryptocurrency Exchange Traded Funds to list on US markets, it is unsurprising Coinbase have chosen to launch a private fund. Yet, Mr Bramanathan was clear about their expansion strategy on a conference call Tuesday:

The first version of this fund for regulatory reasons will be limited to US accredited investors but as we build more funds we’ll make them available to US retail investors…(broad goal) We’re working on that as quickly as we can.

Whether Coinbase will attract regulatory approval or assets is another matter. The company has attracted controversy, including consumer complaints of over-charging, unapproved debits from customer bank accounts and wire transfers not reaching crypto-currency wallets. In January alone, customer complaints to the Consumer Financial Protection Bureau more than doubled. There is also an internal investigation into insider-trading by employees, and an ensuing lawsuit seeking class action status.

While Coinbase have not commented on the lawsuit, it has responded to customer concerns on their support blog, and said it aims to take measures to remedy problems with customer service within the next 90 days.

As for institutional adoption of crypto, the launch of the Coinbase Index feels like an acid test for the market. Watch this space to see if this is what prompts professional investors to plunge into a market where absurd profits, and more predictable losses, so far have rambunctiously passed them buy.

Read Again Broooh https://ftalphaville.ft.com/2018/03/07/1520416333000/Crypto-Goes-Passive/Bagikan Berita Ini

0 Response to "Crypto Goes Passive"

Post a Comment